Frequently Asked Questions

Property

This answers some of the commonly asked questions that clients have. If you have a question that is not covered in the list below, then please let us know.

Usually the legal fees to act for you in your residential sale will fall within the range of £850 plus VAT for a simple transaction with a property valued at £200,000 and under, through to £1,110 plus VAT for a property valued in the range of over £300,001 to £500,000. If the property you are selling is valued over £500,001 an individual quote will be provided.

If the property you are selling is leasehold or unregistered then an additional fee of £350 plus VAT will be applied.

Additional fees that apply will include:

- Bank telegraphic transfer fee to include additional costs and bank charge – £35.00

- VAT thereon at 20% – £7.00

- ID/AML Check – £10.00 per seller

- VAT thereon at 20% – £2.00

Disbursements

- Land Registry Office copies – £6.00-£15.00 depending on the property type. This varies depending on how many documents are filed under the title register.

Property Purchase approximate fee guide

Usually the legal fees to act for you in your residential freehold purchase will fall within the range of £975 plus VAT for a simple transaction with a property valued at £200,000 and under through to £1,200 plus VAT for a property valued in the range of over £300,001 to £500,000. If the property you are purchasing is valued over £500,001 an individual quote will be provided.

If the property you are selling is leasehold or unregistered then an additional fee of £350 plus VAT will be applied.

Additional fees that apply will include:

- Bank telegraphic transfer fee to include additional costs and bank charge – £35.00

- VAT thereon at 20% – £7.00

- Electronic ID Check per person – £10 per purchaser

- VAT thereon at 20% – £2.00

- Lawyer Check – £16.50 – if required

- VAT thereon at 20% – £3.30

Disbursements:

- Bankruptcy Search – £2.00 per purchaser

- Searches on purchase – £250-£450 – we can advise which searches will be applicable to your purchase

- VAT thereon at 20% –£50-£90

- Land Registry Searches

- Stamp Duty Land Tax – please refer to the HMRC tax calculator Stamp Duty Land Tax Calculator

- Land Registry Fee – This is calculated using reference set by HM Land Registry HM Land Registry: Registration Services fees – GOV.UK (www.gov.uk)

- Lender Mortgage Service fee – from £15.00 – (only applicable to certain mortgages)

- VAT thereon at 20% –£3.00

New Build Properties and Shared Equity

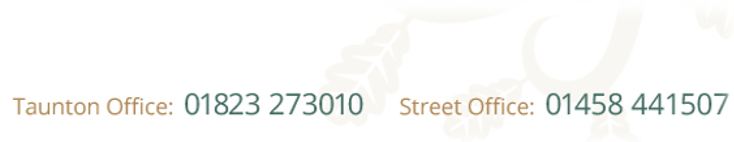

We can deal with the purchase of these properties in our Street office. There are extra fees involved with these types of properties so we suggest you contact our Street Office property team for an individual fee quote.

Each transaction is different so we suggest you contact us for a fully costed fee quote.

VAT – Value Added Tax is payable at 20% on any legal work or bank transfers we undertake for you in your property transaction. VAT also applies to some of the searches that we conduct or if we instruct third parties. In our quotes we set out when VAT is applicable.